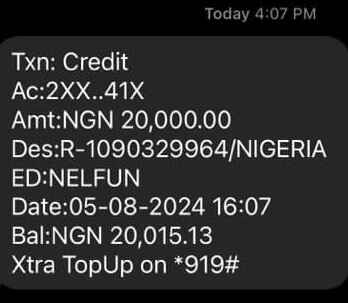

A few days ago, the Nigerian Education Loan Fund (NELFUND) silenced critics who claimed that the student loan program was a political scam. Not only did they disburse school fees to applicants, but they also credited their bank accounts with monthly stipends.

This announcement led to a surge in the number of applications the portal received in less than 72 hours. Undergraduates who had initially been hesitant rushed to apply for the loan, encouraged by beneficiaries who shared proof of the upkeep loan disbursement they received.

NELFUND has also made a separate post on its social media handles, such as X and Facebook, calling on beneficiaries to upload proof of disbursement. While this is a positive step, the management of the Fund should consider taking further action to earn the credibility it deserves.

Why should NELFUND publish names of beneficiaries of the student loan?

Sign of seriousness about data

Past government intervention programs such as N-Power and Nigerian Youth Investment Programme (NYIP) have been plagued by a lack of data on beneficiaries.

In most cases, the government only announces vague figures at press conferences, and that’s where it ends. NELFUND should not follow this path.

Publishing the names of students who are benefiting or have benefited from the program will significantly change the narrative around Nigeria’s approach to data management.

Data is crucial for planning and development. The saying “Stealing from children is a taboo” seems to hold no weight, as the political class has been mismanaging resources and depriving the younger generation of opportunities since Independence.

The management of NELFUND should avoid letting emotions cloud their approach to transparent data management.

Publishing the names of beneficiaries, along with their institutions, for verification will not only enhance the credibility of the student loan disbursement but also inspire private individuals, investors, and education enthusiasts to invest heavily in the program.

Transaction evidence

Let me explain the situation this way: Imagine you claimed to have paid for my cinema ticket, but you refused to send me any proof of payment. Then, you asked me to go to the cinema to watch a movie of my choice. Wouldn’t they ask for evidence of payment at the entry point?

In a similar manner, we may soon see angry bursary officials demanding all sorts of proof of payment from students if the Fund fails to provide evidence of the institutional loan payment to the beneficiary.

Transparency and accountability

There is a significant accountability deficit among government agencies in Nigeria. For NELFUND to stand out and operate differently, it must ensure that transparency is the hallmark of its operations.

For instance, the Fund claimed to have disbursed N1.17 billion to 20,000 undergraduates, but people are asking: Who are these beneficiaries, and where are their names?

Some Civil Society Organizations (CSOs), such as the Coalition Against Corruption and Bad Governance (CACOBAG), have long raised concerns about accountability and transparency. Although the Managing Director and CEO of NELFUND, Akintunde Sawyerr, assured that measures are in place to make it extremely difficult to siphon funds meant for students, stating that “stealing from children is a taboo,” concerns persist.

While the Fund has encouraged beneficiaries to post proof of payment, this is insufficient. How many beneficiaries are active on social media, and how many would be willing to publicly disclose that they have benefited?

NELFUND should create a publicly accessible database of loan beneficiaries. This is the only way the management of the Fund can demonstrate its genuine commitment to transparency.

To serve as reference point for parents

The student education loan programme is designed to ensure that no Nigerian student is denied access to higher education due to financial constraints, while also relieving parents who struggle to pay their children’s tuition fees.

However, some students, lacking consideration for their parents’ financial difficulties, may pressure their parents to pay tuition fees even after securing a NELFUND loan.

To prevent such situations where students take out government-backed loans but still collect fees from their parents, NELFUND should publish a list of education loan beneficiaries. This public record would serve as a reference point for parents to verify their children’s loan status.

Even if a parent lacks internet access, someone in the family or community could assist in checking this information. An insincere beneficiary might mislead their parents, causing them to continue struggling to pay school fees, unaware that their child has already secured a government loan.

Making this information accessible would promote transparency and prevent misunderstandings that could undermine the programme’s reputation.

Clear air about NELFUND being a political gimmick

No one can deny that Nigeria’s education loan initiative is a good idea. However, the political atmosphere in the country has made it difficult for those who lost in the elections to see anything positive in the current government’s actions.

Due to a lack of trust, some people believe that NELFUND is just another political gimmick designed to deceive the poor masses by disbursing loans to only a few individuals while falsely claiming that thousands have benefited.

The only way for the government to dispel this misconception is by creating a data page on its portal where everyone can see real-time information on disbursements, the number of beneficiaries for the upkeep loans, and the institutions receiving the institutional loans.

To minimise disbursement controversy between student and institutions

The disbursement of institutional loans by NELFUND is structured so that payments are made directly to the institution’s bank account under the beneficiary’s name. This strategy is the best way to ensure the funds are used for their intended purpose. However, there are potential issues to consider:

Will the Bursary Department of the institution that received the funds keep their records up to date?

Will some officials in the Bursary Department not treat students with disdain when beneficiaries ask them to confirm their payments from NELFUND?

We must acknowledge the challenges in obtaining information from certain campus offices and the way some students are treated.

To prevent these potential issues, NELFUND should either publish the names of beneficiaries on its website or send a tracking number or code to the beneficiaries. This code can be used by the beneficiaries to confirm their payment with their institution’s Bursary Department.

Model for African countries

Higher education financing is still highly subsidised in many African countries, with many of them yet to implement education loans for their students.

The successful implementation of the NELFUND program in Nigeria could serve as a model for other African countries considering a similar approach. Executing it correctly is crucial, as the rest of the continent often looks to Nigeria as a role model.

Student loan data point in Nigeria

There may be issues with access to data access when NELFUND directs everyone seeking information about student loan beneficiaries to the Bursary Department of every institution in the country.

To streamline this process, NELFUND should consider creating a separate data page for the beneficiaries that is accessible to everyone, both within and outside Nigeria.

Join EdubaseNG WhatsApp Channel to get the latest education & student loan tips

Join our Telegram Channel to get the latest news about Student Loans & Education News.

Are you a stakeholder in education? You can become our guest writer. Write to us using our our email address here