The Nigeria Education Loan Fund (NELFUND) initiative is a 2-in-1 education funding opportunity for undergraduate students in Nigeria that covers tuition fee and upkeep allowance.

Here is the difference between an upkeep loan and institutional loan.

1) An Institutional Loan refers to the school fees of students which is paid directly into the institution’s account on behalf of the loan applicant while an Upkeep Loan under the initiative is a type of loan paid directly into the bank account of a successful applicant specifically designed to help students cover their living expenses while studying.

2) A list of students whose fees have been paid will be published by their institution. To get update about disbursement of your tuition fees, get in touch with your institution’s bursary department if you haven’t been contacted, but you will get a credit alert for upkeep loan.

3) The goal of the upkeep loan is to ensure that students can focus on their studies without worrying about day-to-day financial burdens while the goal of the institutional loan is to ensure that students don’t drop out of school because of the inability to incur tuition fees.

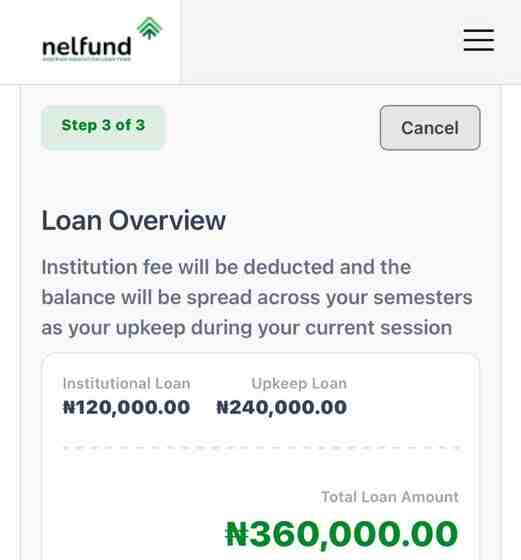

The student loan is divided into two categories: institutional and upkeep loan. For instance, if your school fee is N150,000 and the allowance is N240,000 (N20K/month), it means a total of N390,000 will be disbursed in your name for the year, while N150K is the institutional loan, the N240K is the upkeep loan.

You may decide to apply for only institutional loans.

4) Institutional loan is to cover tuition fees while upkeep loan covers the costs for feeding, printing of academic materials, accommodation, transportation, and other personal needs that students might need in the course of study.

5) For a fresher, the outline of tuition fees may include basic school fee, medical fee, faculty fee, acceptance fee, student union fee, sports fee, ICT fee, result verification fee, identity card fee, and library fee among others.

When your institution receives the institutional loan, they know how to disburse it to cover other fees that make up the school’s fees.

As for upkeep loan, it may cover exigencies such as typing and printing of assignments, feeding as the brain needs glucose and needs food to concentrate in the course of studying.

6) The institutional loan is paid once in an academic session and paid directly into the school account till the applicant completes their undergraduate studies, but the upkeep loan is paid monthly and spread across the academic calendar. Upkeep loan is N20,000 per monthly (N240,000 for a year).

7) While you will receive a credit alert for the upkeep loan, it is not so for institutional loans because it is not designed to be credited into the institution’s account. You will get an update from your institution when your tuition fee is paid.

The upkeep loan is like your monthly pocket-money given to you by your parents or guardian.

Similarities

Both loans are designed to help students cover tuition fees, accommodation, and other educational expenses.

Both loans are part of the broader framework aimed at making higher education more accessible to Nigerian students.

They come with zero interest rates and more flexible repayment terms compared to other types of student loans, making them a crucial support mechanism for students in need of financial assistance.

If both loans show “verified” on your NELFUND dashboard, it means you will receive a credit alert for upkeep and your tuition fee will be paid.

Join EdubaseNG WhatsApp Channel to get the latest education & student loan tips

Join our Telegram Channel to get the latest news about Student Loans & Education News.

Are you a stakeholder in education? You can become our guest writer. Write to us using our our email address here